26 Taxable income band MYR. BASIC TAX INFORMATION MALAYSIA - 2019 6 P a g e OTHERS INCOME TAX RATES Non-resident person other than companies 28 Non-resident company 24 Trust body 24 Cooperative society scale rates Maximum of 24 Amounts above RM750000 Limited liability partnership Same as company CONCESSIONARY RATES APPLY TO THE FOLLOWING.

Everything You Need To Know About Running Payroll In Malaysia

Taxable income band MYR.

. You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to. On the First 20000 Next 15000. Jalan Rakyat Kuala Lumpur Sentral PO.

According to a report prepared by the Department of Statistics Malaysia on Gross Domestic Product GDP seven states have surpassed the national level by 43 for the year 2019. Malaysia Residents Income Tax Tables in 2020. A graduated scale of rates of tax is applied to chargeable.

Heres a look at the tax brackets for 2019 and what they could mean to you. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. 20192020 Malaysian Tax Booklet.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. A gains or profits from a business. 20182019 Malaysian Tax Booklet 8 Classes of income Income tax is chargeable on the following classes of income.

Resident Individual Tax Rates for Assessment Year 2018-2019. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. The income tax system in Malaysia has 12 different tax brackets.

1000001 to 2000000 Tax rate. C dividends interest or discounts. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai.

No other taxes are imposed on income from petroleum operations. B gains or profits from an employment. On the First 50000 Next 20000.

With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased. Chargeable Income Calculations RM Rate TaxRM 0 - 5000. It incorporates key proposals from the 2020 Malaysian Budget.

On the First 5000 Next 15000. Friday 11 Oct 2019 601 PM MYT. Taxable income band MYR.

Effective for YA 2019 and YA 2020 Corporate Tax. Petroleum income tax. For more details check out our detail section.

KUALA LUMPUR Oct 11 Putrajaya will raise the tax bracket for millionaires earning RM2 million onward to 30 per cent Minister of Finance Lim Guan Eng announced when tabling Budget 2020 today. 11 rows Review the 2019 Malaysia income tax rates and thresholds to allow calculation of salary after. 14 rows Malaysia Personal Income Tax Rate.

On the First 35000 Next 15000. On the First 70000 Next 30000. 13 rows 2000000.

Malaysia Income Tax Brackets and Other Information. D rents royalties or premium. Increase to 5 from 0 for citizens and permanent residents.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Selangor achieved an increase of 67 while the Federal Territories by 6. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file.

Increase to 10 from 5 for non-citizens and non-permanent residents. Effective for YA 2019 Tax relief on net savings in the SSPN is to be increased from RM6000 to RM8000 annually. On the First 5000.

Taxable income band MYR. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Income tax rates 2022 Malaysia.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. The income tax rate for SMEs and LLPs on chargeable income of up to RM500000 is to be reduced from 18 to 17. A non-resident individual is taxed at a flat rate of.

Box 10192 50706 Kuala Lumpur Malaysia Tel. Increase to 10 from 5 for companies. Income Tax You.

E pensions annuities or other periodical payments not falling under any of the. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. It should be noted that this takes into account all.

Income Tax Rates and Thresholds Annual Tax.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

![]()

New Road Tax Rates For Ev S In Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Cukai Pendapatan How To File Income Tax In Malaysia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

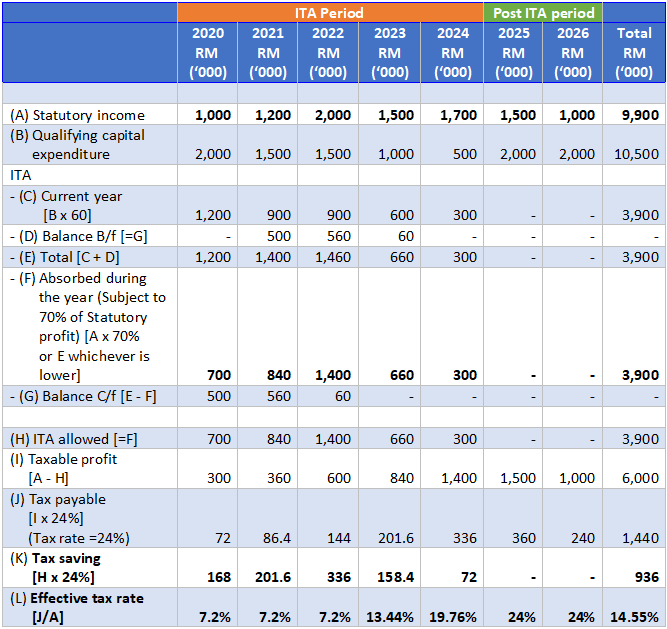

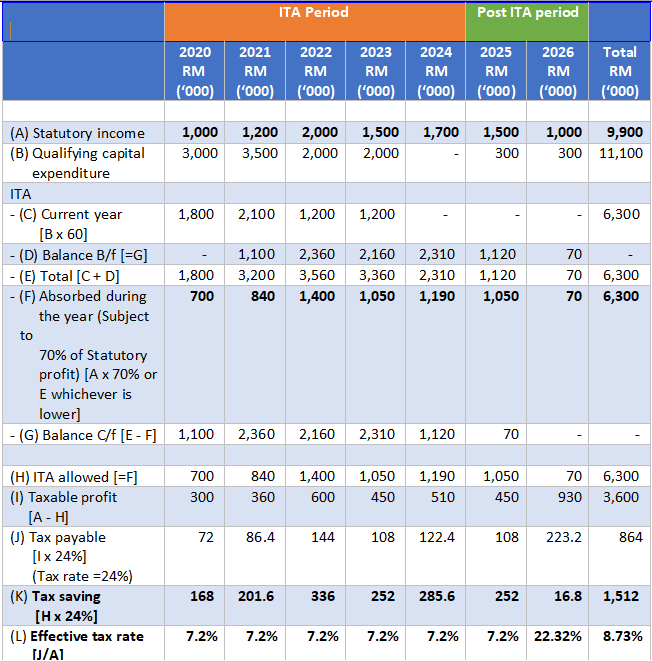

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2019 Income Tax Calculator Factory Sale 57 Off Www Ingeniovirtual Com

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysian Tax Issues For Expats Activpayroll

Personal Income Tax E Filing For First Timers In Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Malaysia Tax Revenue 2019 Statista

Oecd Overlooks Amazing Success Of Low Tax Singapore Urges Higher Taxes In Asia Cato At Liberty Blog

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News